What China vs US economy means for investors

As the rivalry between the US and China intensifies and becomes the new norm, the companies and trading partners most caught in the middle scramble to keep up with the demands of a global tech sector that is effectively cloning in two.

Key takeaways

Amid the splintering of the old "Group of 2", technology has become an industrial and political battleground.

While the bifurcation of tech industries is not the most efficient way to build global supply chains, it does have some benefits.

The US and its allies have seen a reverse flood of onshoring jobs and China has cut into the West’s lead in advanced chipmaking.

We favor the agile enablers of these shifts, notably semiconductor equipment makers.

The US-China relationship is the most important and complex in the world today. Both countries have global reach but different histories, cultures, ideologies and forms of government. Still, for decades, this “Group of Two” (or “G2”) relationship appeared to be working well for both sides, greater Asia, and the world.

Over the past 10 years, there has been a growing rivalry as China sought to expand its global political and economic influence. The response of the US has been to use technology as the centerpiece of its policy responses. Given China’s ability to copy US intellectual property (IP), the US is limiting its access to chips, chip manufacturing technology and other IP deemed critical to US national security. Further, the US and the West have taken the position that some tech goods manufactured in China present a security and surveillance threat. This dynamic has created a fissure between the countries and caused China to seek to develop its own technology industrial base.

While the bifurcation of tech industries is less efficient and cost-effective than a globalized model, it is not without some offsetting benefits. The redundancies now being built in semiconductor supply chains, electric vehicle (EV) batteries and solar panels is a result of this divorce. They add to the economic activity in and around both neighborhoods. It is also somewhat inflationary over the short run as the two compete for resources.

Recently, as talks have picked up between China and the US to thaw relations, another possibility has emerged as well: that the added distance ultimately makes for a more civil and stable arrangement.

Where did G2 polarization come from?

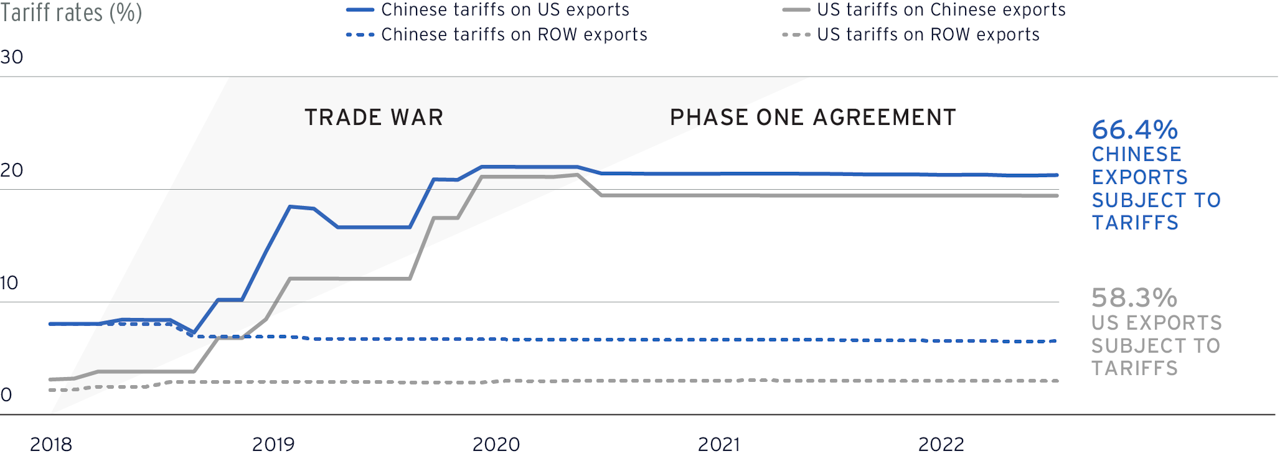

In June 2018, the Trump administration imposed tariffs on China to combat what it felt were unfair trade practices (Figure 1). That led to a series of tit-for-tat trade war actions by the two countries. The succeeding administration of President Biden left these measures in place.

Faced with an absence of vaccines and hospital capacity, China implemented a strict “zero-COVID” policy that made travel into, out of and within China all but impossible, and instituted lockdowns that inhibited global manufacturing and trade. This put great economic pressure on China and made it more isolated.

During this time, the US banned the export of certain chips vital to China’s development of advanced weapons systems and China followed by restricting exports of rare earth elements essential to the US production of EVs. Then the Biden administration doubled down by invoking national security to make it harder for US firms to invest in certain Chinese companies.

As tensions rose, the issue of Taiwanese independence became a greater political hot button. As a result, China accelerated its military operations in the Taiwan Strait even as Nancy Pelosi and other US elected officials flew into Taipei in solidarity.

A rougher-than-expected unwinding of a property bubble added to China’s economic woes. China stepped up enforcement against alleged espionage activities by the Chinese operations of foreign firms. Faced with a souring political and economic environment, a growing number of Western businesses began rethinking their future in the country.

FIGURE 1: US-China tariffs on each other and the rest of the world

Source: UN Comtrade, Trade Map and Market Access Map, as well as announcements from China’s Ministry of Finance’s and USTR, as of November 22, 2023.

Impacts of the new status quo

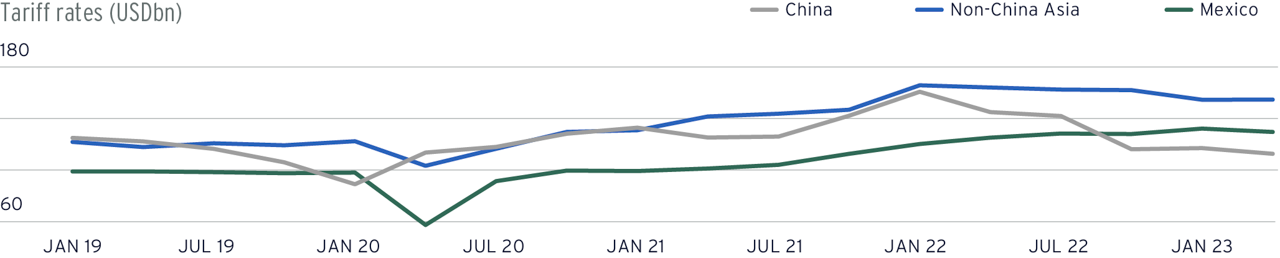

The impact of G2 polarization on global supply chains, trade patterns and foreign direct investment (FDI) is plain to see in the data. For example, China’s exports to the US have dropped 30% since peaking in the first quarter of 2022, as exports from Mexico to the US have steadily risen and ex-China Asia exports to the US have leveled off (Figure 2). Meanwhile, there has also been a sharp drop in semiconductor exports from the US and two of its allies – South Korea and Taiwan – to China, with year-to-date declines of 29%, 24% and 13%, respectively, through October 2023.

FIGURE 2: US imports from China, non-China Asia and Mexico

Source: Haver Analytics, as of November 22, 2023. Note: Non-China Asia includes Taiwan, South Korea, Japan, and some key ASEAN such as Singapore, Vietnam, and Malaysia.

In March 2023, the US entered an agreement with Japan to help strengthen each other’s critical minerals supply chains and reduce their dependency on China through, among other strategies, the development of EV batteries using fewer rare earths.

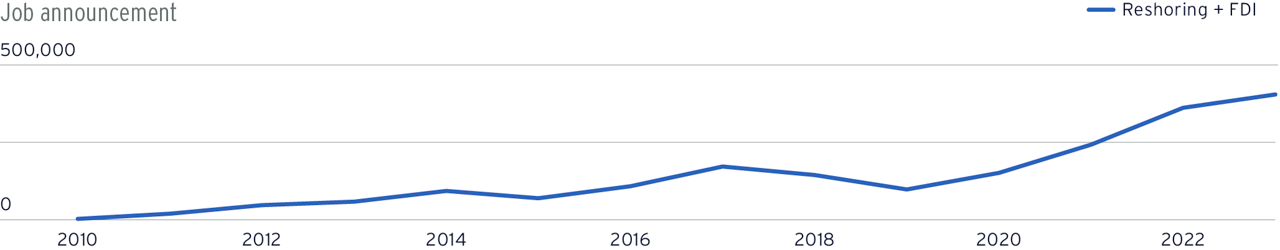

In the US, manufacturing job announcements related to reshoring and FDI have climbed and may top 400,000 in 2023 (Figure 3). If that happens, the US will have recovered 40% of the 5 million jobs lost to offshoring prior to 2010, according to the Reshoring Initiative. Many of the job announcements are skewed toward areas targeted by recent US industrial policy.

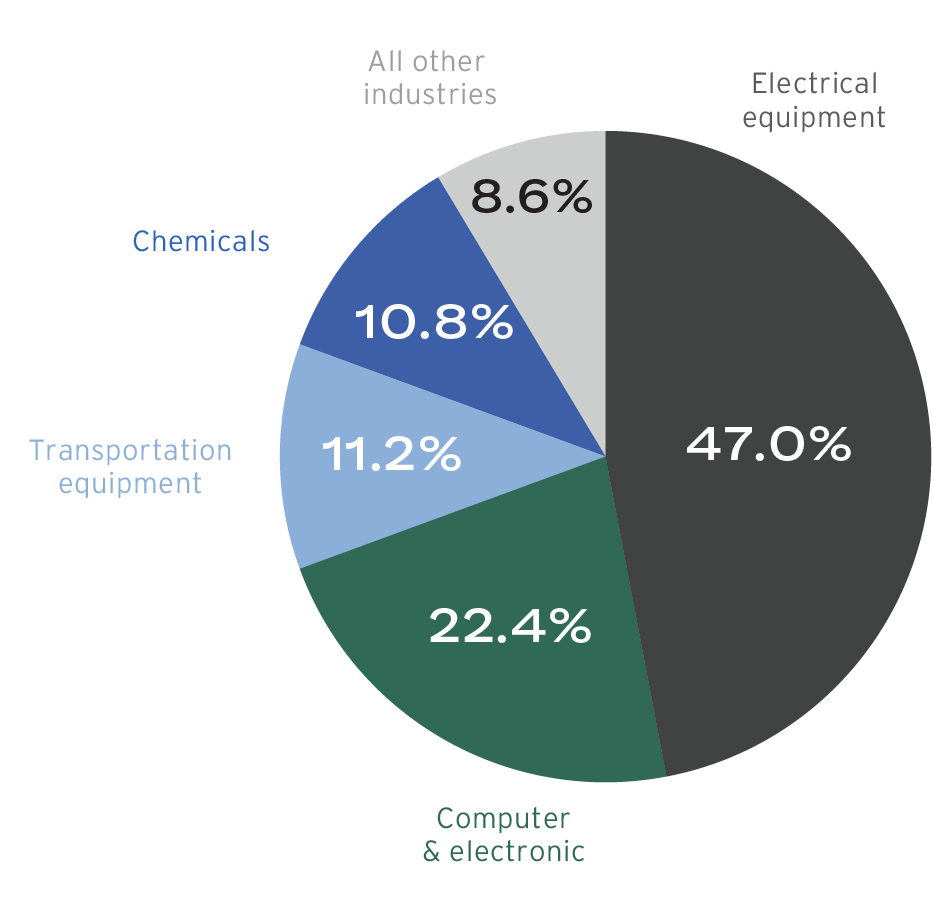

Almost half these job announcements have been in the electrical equipment category which includes EV batteries (Figure 4). The computer and electronic products category incorporates solar panels, robotics, drones and semiconductors. The chemicals category: pharmaceuticals, renewable fuels and rare earth products.

FIGURE 3: US reshoring & FDI job announcements

Source: Reshore.org as of Aug 18, 2023. For illustrative purposes only.

Source: Reshore.org as of Aug 18, 2023. For illustrative purposes only.

Figure 4: Percent of reshoring and FDI US job announcements by industry, 2023 projected

Source: Reshore.org as of Aug 18, 2023. For illustrative purposes only. All forecasts are expressions of opinion and are subjectto change without notice and are not intended to be a guarantee of future events.

Western businesses leaving China

US-China tensions and the slowing Chinese economy have chipped away at the confidence of US businesses operating in China. In 2023, the American Chamber of Commerce (AmCham) in Shanghai found that just 52% of 325 firms were optimistic about the five-year business outlook in China, the lowest level since the annual survey began in 1999.1 Uneasiness over China’s policies and regulations toward foreign companies were another area of concern.

One key takeaway is that 40% of these firms, up from 34% a year ago, are currently redirecting or looking to redirect investment originally intended for China, mainly to Southeast Asia. Part of this may reflect a wider shift in global manufacturing and supply chain management. But some firms clearly view US-China relations as being important to their business success, with 46% believing that the bilateral relationship will continue to deteriorate.

At the same time, the size of China’s market, its influence and its growing middle class cannot be ignored. When asked about moving existing manufacturing and sourcing outside of China, 74% of the US firms in the AmCham survey said they were not considering it. But it seems a growing number see manufacturing in China these days as a strategy for selling in China rather than as a strategy for more efficiently selling to the entire world.

China has also been on the move. The US high-tech embargo and sanctions on China have pushed China to become more self-reliant and innovative. The result has been that Chinese companies have been making significant strides in semiconductor manufacturing and the fifth and sixth generation (5G and 6G) of mobile communications. That’s in addition to China’s leadership in 37 of 44 technologies tracked by the Australian Strategic Policy Institute, in fields ranging from batteries to hypersonics. China’s particular strengths include nanoscale materials and manufacturing, hydrogen and ammonia for power generation and synthetic biology, to name a few.

Forward implications

The upcoming decade could be fraught with tension. While Taiwan’s electorate seems like it could be more reluctant to stir the pot, its January 2024 elections will be watched carefully by China, the US will be monitoring China’s reactions, and vice-versa. The November 2024 US election cycle is apt to come with hawkish geopolitical rhetoric. Looking past the rhetoric, actions like deterrence and the projection of military power could determine if the floor for future areas of engagement and cooperation between the world’s two largest economies rises or falls.

The Biden administration describes its sensitive technology strategy regarding China as a small yard and high fence.

2 The meaning of “small” has varied over time. The administration considered restricting investment in Chinese companies working in biotech and critical mineral mining. There was also a question as to whether chip-related prohibitions would extend so broadly that they could start to severely impact China’s electronics and EV industries, not to mention the profits of large Western tech companies for whom those industries are a major market.

In recent months some more clarity has emerged. After the latest updates issued in October, a few US and European chip designers and equipment makers balked at the stepped-up provisions closing loopholes in the types of high-end technology banned, while also acknowledging that they do not at this time anticipate a material effect on sales.

China has carved out some more breathing room for itself as well. Huawei’s latest cell phone, the Mate 60 Pro, features breakthroughs in 5G and integrated circuit chip manufacturing and comes with satellite communication capability – something even the iPhone does not have.

China’s response to tech competition

As part of the Western embargo, China can no longer import the world’s most advanced chipmaking technology – Dutch-made “extra ultraviolet” (EUV) lithography machines. As a workaround, China has developed a new process using a particle accelerator to imprint the nanoparticle-sized circuity. A vast factory is now under construction in Xiongan. As recently as this year, Chinese producers were believed to be eight years behind their counterparts across the Strait in the processing power and speed of their chips.

Coincidentally or not, during the May 2023 G7 summit in Hiroshima, President Biden proclaimed that ties with Beijing would thaw very shortly.

High-level officials from both countries subsequently started to meet more frequently, setting the stage for a reasonably constructive mid-November face-to-face meeting between Biden and Chinese President Xi Jinping held on the sidelines of an Asia-Pacific Economic Cooperation forum in San Francisco.

China still receives billions in US-designed chips every month and the US still depends on Chinese critical minerals. The US is China’s largest export market. After Canada and Mexico, China is the US’s next largest. For better or worse, these two countries remain highly reliant on each other. Now, with each perhaps feeling a little more independent, just maybe they can stick a bit more to “business as usual.”

Investment implications

As investors, we believe in seeking geographical portfolio diversification with allocations that capture exposure to the global champions, agile players and beneficiaries of the supply chain transitions and changing trade patterns underway. In addition to the US and China, these companies can also be found in other areas of the world, including friends, allies and trading partners such as Vietnam and Mexico.

Broadly speaking, despite the return of jobs to the US, it would be cost-prohibitive to replace production and manufacturing performed in China on a one-to-one basis. Manufacturers integrating robotics and AI-enabled logistics to combat the higher labor costs associated with reshoring stand to benefit the most. Beneficiaries also include the suppliers of that equipment, such as the large US, Japanese and European industrial automation and supply-chain management firms. Another winner looks to be the large industrial real estate investment trusts sitting atop much of the zoned-industrial and warehouse properties on either side of the Atlantic.

Within the most sensitive parts of supply chains, the leading Taiwan-based chip fabricators would prefer not to have to build out new capacity in the US and Europe as Western security concerns are pressuring them to do. (The economics would be better if they could keep the activity in Taiwan.) For the producers of the high-end equipment going into those fabs, however, all that new fabrication building is a net positive (assuming they can keep up with the orders). New capacity building in the US, Japan, and South Korea should more than offset the decline of the equipment makers’ business in China, which increasingly, it appears, will have its own high-end suppliers to invest in.

Moreover, for agile companies there is a cyclical element at play. We think there will be a tailwind for the most global players when manufacturing and economic growth accelerate under less restrictive monetary policies in 2024–2025.

Download your copy

Discover our Wealth Outlook 2024 insights and themes.