What makes us one of the best global private banks

Citi Private Bank is like no other. We take a distinctive family approach to serving our unique clients and their loved ones.

Comprehensive services for your wealth

We customize our offering to help you protect and grow your wealth.

Meet our people

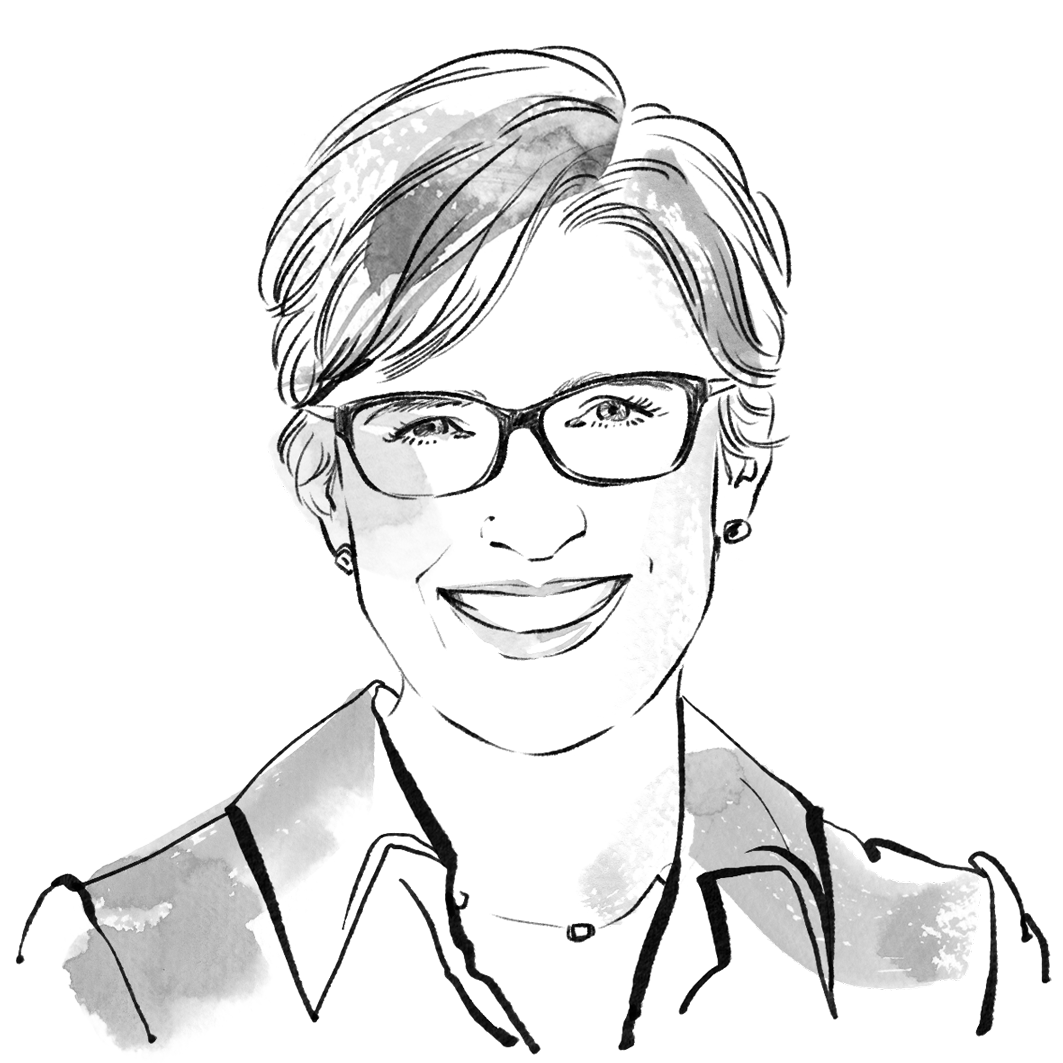

Jane Fraser

Meet our wealth expert

Jane became CEO of Citi in March 2021. She is the first female CEO in the firm’s history. Previously, she was President of Citi and CEO of the Global Consumer Bank.

Jane has also served as CEO of Citigroup Latin America, CEO of US Consumer and Commercial Banking and CitiMortgage, CEO of Citi Private Bank and Global Head of Strategy and Mergers & Acquisitions.

Before joining Citi, Jane was a partner at McKinsey & Company. She started her career in mergers & acquisitions at Goldman Sachs and then worked for Asesores Bursátiles.

Jane is Vice Chair for Partnership for New York City and a member of the Harvard Business School’s Board of Dean’s Advisors, the Stanford Global Advisory Board, the Economic Club of New York and the Council on Foreign Relations.

Jane has an MBA from Harvard Business School and a master’s in economics from Cambridge University.

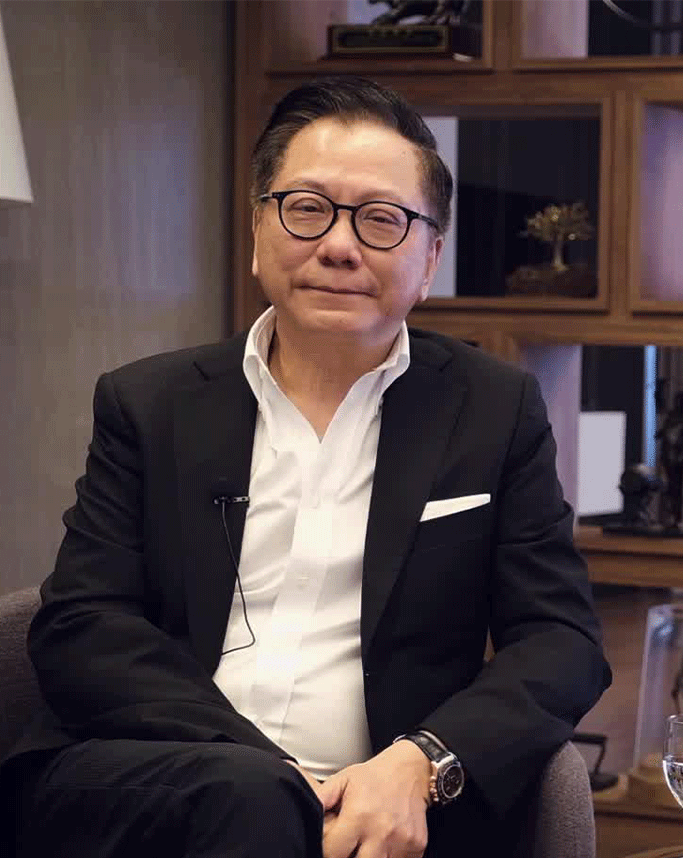

Andy Sieg

Meet our wealth expert

Andy Sieg joined Citi in September 2023 as Head of Wealth. He is a member of Citi’s Executive Management Team.

Andy was previously the president of Merrill Wealth Management, where he oversaw a team of more than 25,000 people providing investment and wealth management services to individuals and businesses across the U.S. He joined Merrill Lynch in 1992, and previously held senior strategy, product and field leadership roles in the wealth management business.

From 2005 to 2009, Andy served as a senior wealth management executive at Citi. He returned to Merrill Lynch in 2009 after the firm’s acquisition by Bank of America. Earlier in his career, Andy served in the White House as an aide to the assistant to the President for Economic and Domestic Policy.

Andy earned a Bachelor of Science in Economics from Penn State University and a Master’s Degree in Public Policy from the Harvard Kennedy School. He serves on the Board of the Friends of Notre-Dame de Paris and as an Advisory Council Member for the Stanford Center on Longevity. Andy is also co-lead of the global Citi Women inclusion network.

Global citizens

Our community of global citizens helps to make the world a better place. It is our privilege to share this selection of stories about their accomplishments.