Residential real estate can be a valuable component within your overall wealth strategy.

In recent years, our clients have increasingly sought properties in key locations around the world, whether for their own use, investment purposes, or as a way to store wealth.

We offer a comprehensive approach to financing and structuring home buying transactions.

Our dedicated team specialize in mortgages for ultra high net worth individuals and families and coordinate all aspects of the lending process until your transaction closes.

They begin the process by understanding your objectives and then customize a financing strategy aligned to your unique circumstances.

Among the benefits of our private bank mortgages are competitive interest rates, no maximum loan amount,1 and a sliding loan-to-value scale that reflects loan amounts and liquidity. We draw upon in-depth knowledge of key local property markets worldwide and our expertise in cross-border financing.

Your dedicated mortgage specialist partners with you to understand your unique objectives, develop a tailored financing strategy, and coordinate all aspects of the lending process.

How we serve you

TAILORED FINANCING STRATEGIES

We design innovative mortgage structures to fit your overall financial strategy.

Our offering includes fixed and adjustable rate mortgages, interest-only options,1 dual-collateral mortgages, blanket mortgages, laddered loans and bridge financing.

We can assist in complex financial situations, including where there are multiple sources of income or alternative ownership structures.

We can also provide pre-approvals, which may give a negotiating advantage.

UNIQUE PROPERTIES

Our clients frequently seek to acquire out-of-the-ordinary homes.

We have a deep understanding of the issues and challenges posed by many one-of-a-kind properties, the likes of vineyards, country estates, farms and ranches.

Our expertise and flexibility allow us to consider lending in situations where other lenders may not.

INTELLIGENT OWNERSHIP

Structuring the ownership of your property can help ease transitions, protect your privacy, and safeguard against legal challenges.

Working with your independent legal and tax advisors, our wealth planners can explore appropriate structures for your unique circumstances.

Possibilities include trusts, partnerships and limited liability companies, both on- and off-shore.

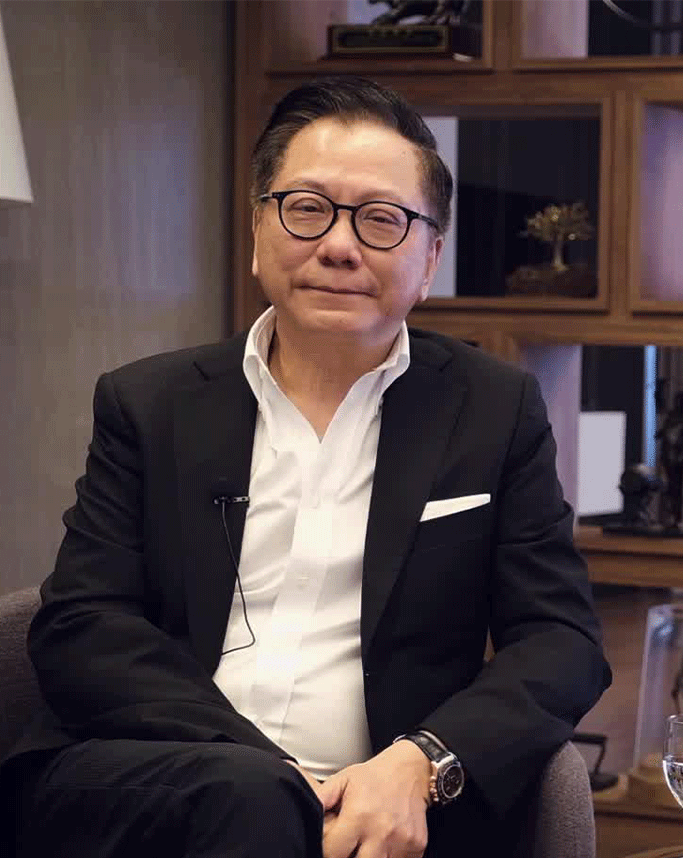

Meet our people

Global citizens

The Private Bank exists to serve a very special community. Hear the stories of global citizens in their own words.