Alternative investment opportunities

In our opinion, alternative investments are like the vegetables of the core portfolio – most qualified investors are not getting enough. Higher forecast estimates and structural tailwinds argue for a heftier serving.

KEY TAKEAWAYS

Alternatives have the highest next- decade return estimates among all of the asset classes in our proprietary asset allocation methodology – and have for the past three years.

The potential for enhanced returns and lower volatility is one of the benefits that a diversified exposure to hedge funds, private equity and real estate may provide for qualified investors.

When investing in alternatives, it is important to understand the liquidity constraints and added risks involved, and why patience is key.

Close consultation with a financial professional can help you choose the appropriate alternatives path for you.

The Global Investment Committee (GIC) suggested allocation for a qualified and suitable moderate-risk investor to alternatives is 12% to hedge funds, 10% to private equity and 5% to real estate and we have provided this roadmap to get you started. Citi Global Wealth has deep capabilities across alternative investments and has multiple analytic tools available to assist you in holistically evaluating portfolio goals and risk tolerance.

With alternatives having some of the highest strategic return estimates (SREs)among all the asset classes in our Adaptive Value Strategies (AVS) framework over the next 10 years, our suggested allocation for an appropriate moderate-risk investor is, in the aggregate, 27%: 12% of the portfolio to hedge funds, 10% to private equity and 5% to real estate for those who understand the level of illiquidity that may be added to a portfolio. We should note that, while prospective returns for alternatives are high, these are also the same expectations and weightings we have recommended for the last three years.

If 27% sounds like a lot to you, consider that alternatives allocations among US institutional investors in 2022 ranged from an average of 34% for state and local pension plans1 to 59% for endowments.2 Although certain subsets of our clients such as large family offices3 are adopters of alternative assets in their portfolios, with the average large family office allocation sitting around 46%,4 allocations to alternative investments by other qualified individual investors remain by and large lower than they should be, in our opinion, with most in the single digits.

Alternative investments come with their own additional risks, including liquidity constraints and the potential for asymmetric losses from the possible use of leverage. Nevertheless, reconsidering your approach to constructing a core portfolio that includes a higher allocation to alternatives has some opportunities:

Private equity and real estate have generated more wealth over time than a portfolio made of exclusively public equities (Figure 1). In our Opportunistic section, see “Investing with and in unregulated financial companies” for an explanation of some of the larger, structural issues creating opportunities for private equity firms today.

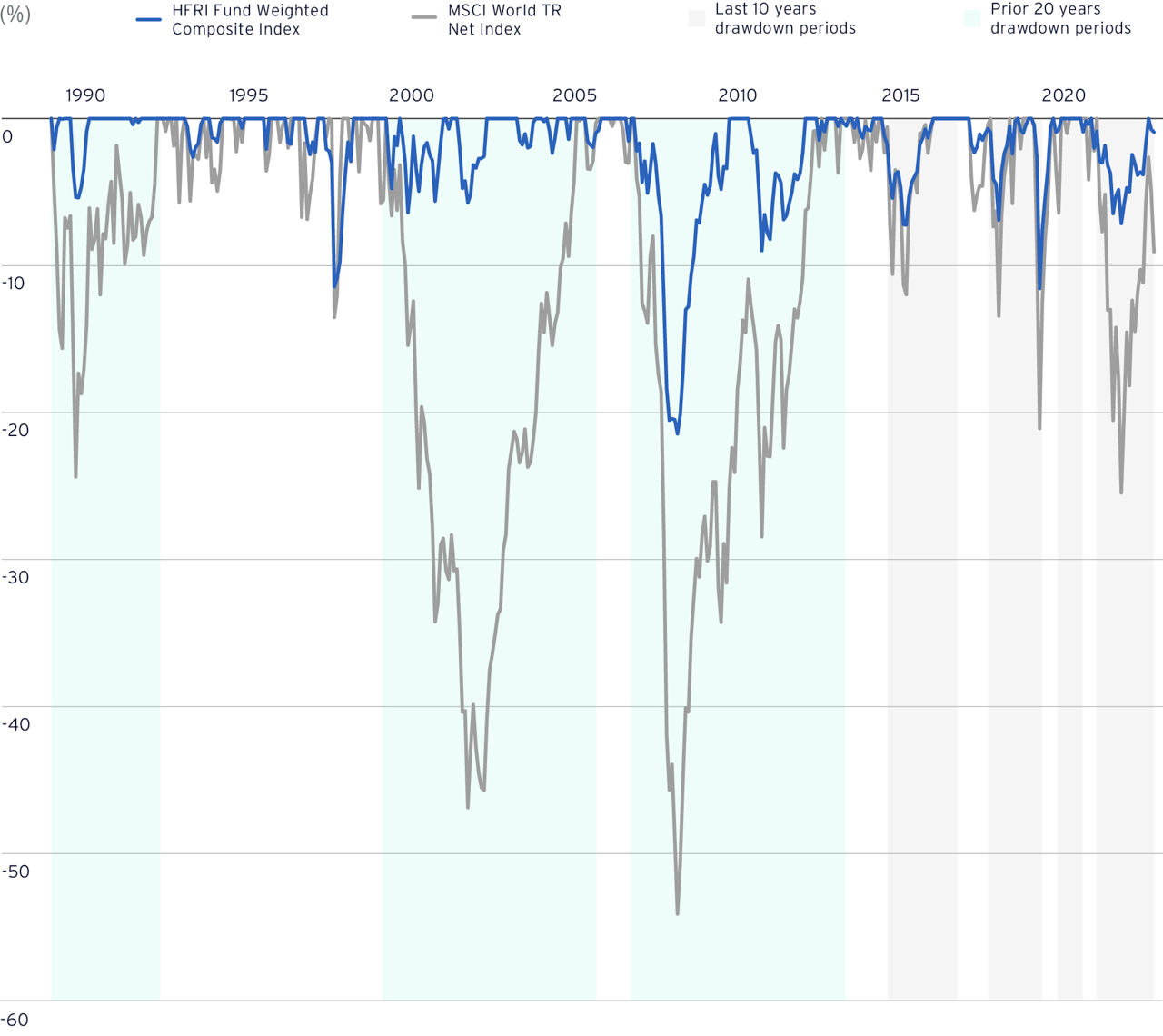

When markets become more volatile, hedge funds have historically proven able to preserve capital better than long-only strategies, with certain funds capable of producing positive returns during negative market periods (Figure 2). That said, they are also subject to potentially higher volatility, can see limited redemptions and can change the risk profile of your portfolio.

Alternative credit strategies, a subset of private equity or hedge funds, can potentially generate a yield premium over traditional fixed income portfolios. At a time when bond yields themselves are higher, the payouts for non-traditional credit can be higher for those willing to stay invested for the long term. Just understand that, unlike with traditional bonds, there are no regular coupons.

Figure 1: Performance of global equity versus a mix of private equity and real estate

Source: Citi Global Wealth (“CGW”) Global Asset Allocation team, as of October 31, 2023. The returns shown were calculated at an asset class level using indices and do not reflect additional fees or expenses, which would have reduced the performance shown. Indices are unmanaged, may or may not be investable, and have no expenses. Diversification does not ensure against loss of investment. Chart displays the performance of the Global Equity asset class, consisting of 90% Developed Market Equity (MSCI World Index and CGW Global Asset Allocation team data) and 10% Emerging Market Equity (MSCI Emerging Markets Index and CGW Global Asset Allocation team data), compared to a private illiquids proxy of 65% Private Equity (Cambridge Associates LLC US Private Equity Index and CGW Global Asset Allocation team data) and 35% Real Estate (FTSE EPRA Nareit Global Index and CGW Global Asset Allocation team data) for the period 1986-2022. Private equity and real estate indices are net of manager level fees and expenses. See Glossary for definitions. Past performance is no guarantee of future returns. Real results may vary.

Figure 2: Historically, long-term hedge fund returns benefit from smaller drawdowns than long-only equities

Source: HFRM, Hedge Fund Research (“HFR”), MSCI; as of September 30, 2023. Drawdown Periods for the MSCI World TR Index. The last 10 years (orange shaded areas) have had fewer and more shallow equity drawdowns than the 20 years prior (green shaded areas). Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary.

Allocating to alternatives

We believe that alternatives are a key part of a core portfolio for qualified clients for whom the potential asymmetric risks and liquidity constraints are appropriate. That also means alternative investments may be evaluated under the same lens as traditional investments, in an integrated manner, starting with an understanding of one’s objectives, risk tolerance and liquidity requirements. Each investor has his/her/their own unique investment objectives that will drive individual asset allocation decisions. There is no one-size-fits-all answer to the question of how to build an allocation with alternatives. However, the alternative investment universe does contain a wide variety of options across the risk/return spectrum to choose from. Let us explore how you might evaluate your own situation to build a more diversified portfolio that includes alternatives.

Know the objectives

Broadly speaking, alternative strategies can be placed into two groups, diversifying and directional strategies. Diversifiers provide some degree of downside protection and can profit from volatile markets but may underperform during bull markets. Directional strategies seek to generate alpha and/or yield above traditional credit and equity exposures. A conservative approach may emphasize diversifying and yield strategies while someone with a more moderate or aggressive profile might add more directional strategies to the mix.

Figure 3: Alternatives strategies can be classified as diversifying or directional

DIVERSIFYING

Seek to provide downside protection and potentially profit form volatile markets

- HEDGE FUNDS

- REAL ASSETS

Relative value, volatility arbitrage, global macro & CTA strategies

Yield-generating infrastructure and core real estate

DIRECTIONAL

Seek to generate alpha above traditional credit and equity exposures

- HEDGE FUNDS

- REAL ASSETS

- PRIVATE CREDIT

- PRIVATE EQUITY

Equity long/short, event driven, credit & distressed strategies

Value-add, opportunistic real estate, co-investments

Direct lending, mezzanine and special situations & distressed

Secondaries, buyouts, growth, venture capital, co-investments

Diversifying and Directional are internal descriptors based on a fund’s strategy and objective that CGW Alternatives has developed and uses to categorize alternatives funds. Such descriptors have not been approved by the portfolio managers of any of the underlying funds making up the Portfolio. The internal classification noted above is subject to change without notice Please see Important Information at the end of this document for the definitions of “Diversifying” and “Directional” funds.

Liquidity needs and parameters

The benefits of adding alternatives to a diversified portfolio are potentially significant, but as noted, these benefits come at the cost of illiquidity. Illiquidity means that some of these strategies have limited or no redemption periods when clients need to access their funds. This requires a holistic evaluation of an entire portfolio within the context of one’s time horizon and liquidity. What are your short- and long-term cash needs? Even the most liquid “liquid alts” funds will only provide for monthly or quarterly cash-out options, not daily. And some strategies will lock up capital for years in seeking to generate returns. Understanding one’s cash needs is among the first risk analyses to be done when setting the portfolio parameters and selecting potential investment opportunities.

Paths to execute the plan

Once you have established the objectives and risk tolerances, you may want to consider a portfolio of individual funds and co-investment holdings or utilize a third-party investment manager for fund/deal selection. An advantage of building a portfolio of individual investments is customization and one less layer of fees; one of the downsides is the added due diligence required by you and your financial professional. A third option may be to outsource manager/fund selection to a platform fund or fund of funds that invests across multiple managers (and often across multiple strategies), accessing ideas of professionals dedicated to each asset class and strategy.

Take a long-term approach

For hedge funds, one can meet an allocation target over a relatively short period of time and then manage exposures dynamically. However, private equity, private credit and real estate take a longer-term plan and implementation period, because they are typically structured as drawdown vehicles that have a finite term. They call the committed capital over a period of three to five years as suitable investments are identified and funded to fill the portfolio. Then invested capital and gains are distributed to investors as the individual portfolio investments are sold over a total fund life of eight to twelve years. Investors may get impatient and try to fully allocate to the asset class in the first year, when the preferred option should be to build a sustainable exposure over time. A rushed approach can then create more angst on the back end as well. We suggest working closely with your investment professional to determine your expected liquidity needs, then developing a slow and steady plan you can stick with over many vintage years.

Download your copy

Discover our Wealth Outlook 2024 insights and themes.