Commercial real estate is an important investment for many of the worldly and wealthy investors we serve.

However, some of the more sophisticated and attractive opportunities within this asset class are only available privately.

For over 25 years, our dedicated team has underwritten, negotiated, and managed financing for real estate portfolios around the world.

Our lending portfolio includes office buildings, multi-family properties, warehouses and distribution facilities, mixed-use or flexspace, and retail centers.

We typically finance assets in the $10 million to $100 million+ range and deliver highly customized short-term and long-term strategies to help meet your specific needs.

Our offering includes a range of flexible loan terms and structures, competitive interest rates and a long-term commitment to funding throughout the real-estate cycle.

We are also skilled at customizing lending structures and may be able to identify untapped potential in properties that other lenders may overlook.

Our tailored financing strategies help facilitate acquisitions and provide liquidity for sophisticated commercial real estate investors.

How we serve you

STRATEGIES BUILT AROUND YOUR NEEDS

Financing can help you acquire, renovate, reposition or refinance property as well as free up liquidity for new projects.

Our commercial real estate lending strategies reflect your financial circumstances in addition to the asset you are financing.

Our responsive loan approval process helps deals to close faster and maximizes your negotiating position.

ACCESS TO FURTHER FINANCING

The Private Bank works closely with Citi’s Institutional Clients Group.

We can introduce you to our real estate investment banking and commercial real estate finance groups.

For qualified clients, a range of investment banking services, including acquisition advice, initial public offerings, and preferred stock and debt placements are available.

LEGACY PLANNING

We can help go beyond your commercial real estate financing needs.

Working with our wealth planners and your independent tax and legal advisors, we can help implement a strategy to pass assets on to beneficiaries of your choosing.

Meet our people

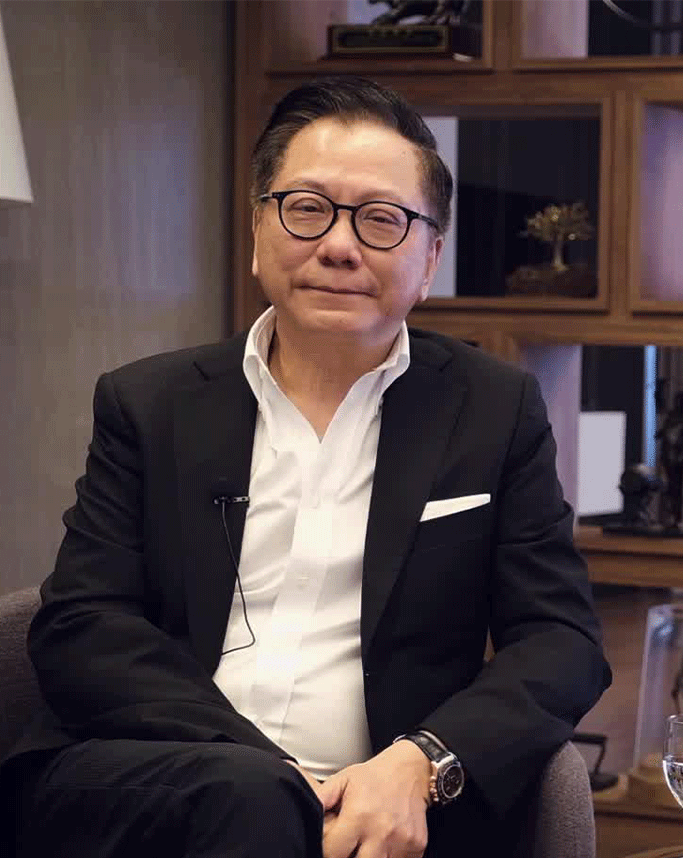

Andrea Galbiati

Meet our wealth expert

Based in London, Andrea is responsible for commercial real estate lending across the region. He re-joined Citi in 2011 as a senior transactor within Investment Finance. Since then, he has led the origination and underwriting of over £2bn worth of commercial property loans secured against London and UK regional assets, including office, retail, logistics and hospitality properties.

Previously, Andrea worked at Stormharbour Securities, where he originated and executed capital raising mandates for senior and mezzanine debt and equity for UK and European commercial real estate opportunities.

Between 2000 and 2008 Andrea worked in European mergers & acquisitions and securitization at Citi, underwriting, structuring, securitizing and syndicating over $5bn of real estate debt.

Global citizens

The Private Bank exists to serve a very special community. Hear the stories of global citizens in their own words.