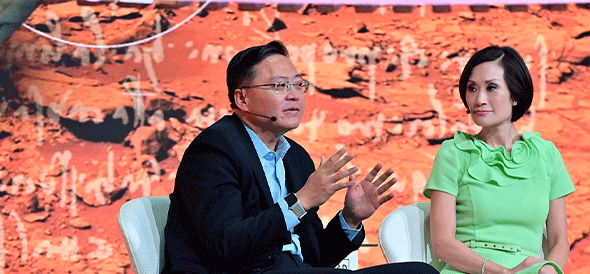

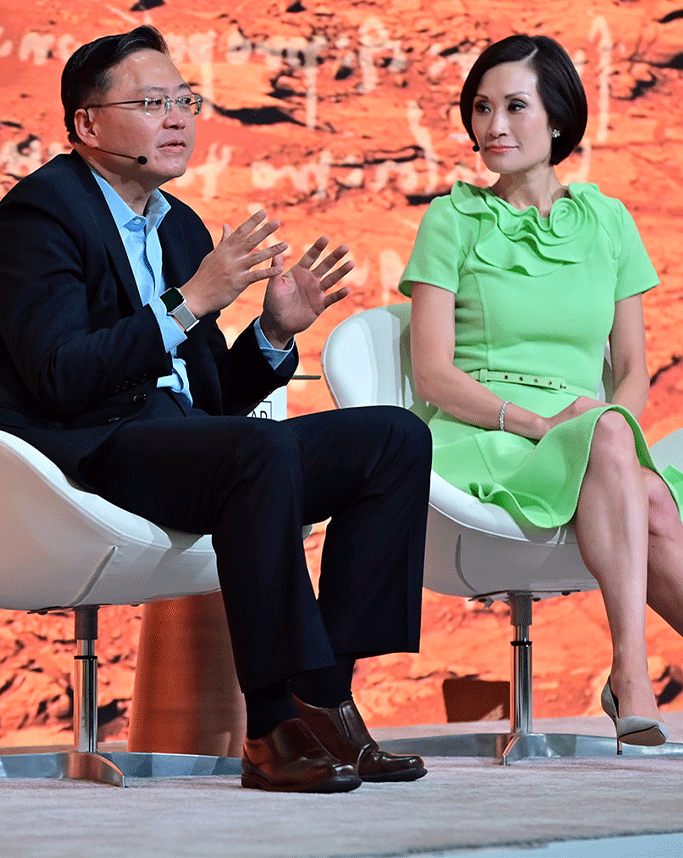

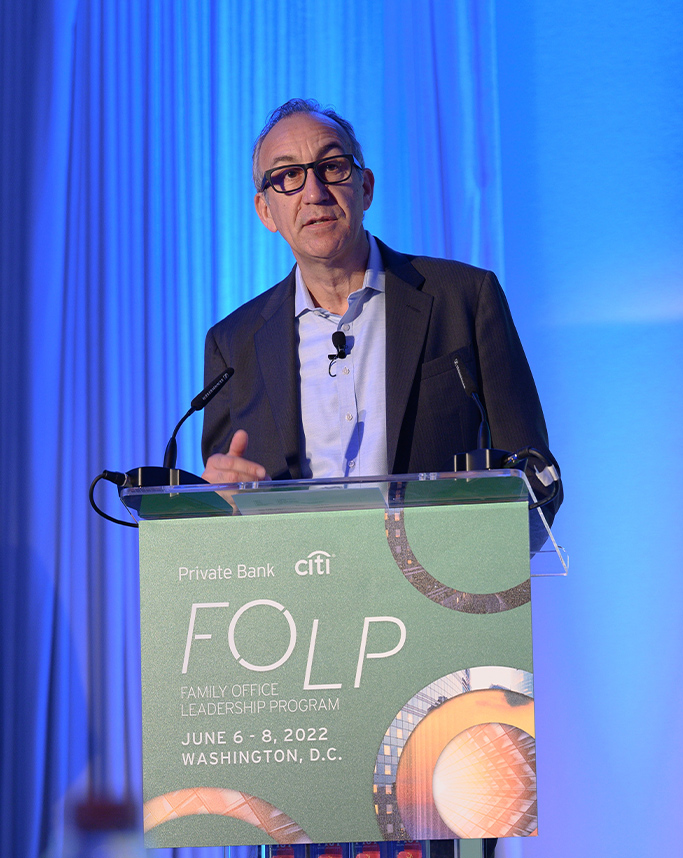

To deliver many of our private client events, we partner with world-leading academic institutions, top thought leaders, and influential practitioners.

To keep you informed and inspired, we host an exciting program of events around the world throughout the year.

Not only do our client events educate and entertain, but they are also excellent opportunities for you to meet and exchange ideas, experiences and best practices with your peers.

We carefully craft the events offered by the Private Bank to address the issues that we know are of most importance to you and your family.

From investment strategy to business succession planning to art collecting to trends in disruptive innovation, we cover diverse topics to benefit Private Bank clients.

We pride ourselves on creating an exclusive and relaxed atmosphere at our Private Bank events where the world’s significant families can share ideas confidentially, build relationships and develop business opportunities with peers from across the globe.

The topics really resonated with us, making us think through how we currently operate and how we lay the groundwork for the next generation.

Events

A selection of highlights from our extensive program