Our IwP offering spans managed opportunities, alternative investments and capital markets strategies that enable you to pursue your financial and sustainability objectives. Whether you seek exposure to individual investments or wish to build entire core and opportunistic portfolios that reflect your worldview and values, we can help you realize your sustainable investing goals.

By nature, clients of the Private Bank are progress makers who strive to improve the world we live in.

Among their priorities are protecting the environment, contributing to a more equitable society and raising standards of corporate behavior.

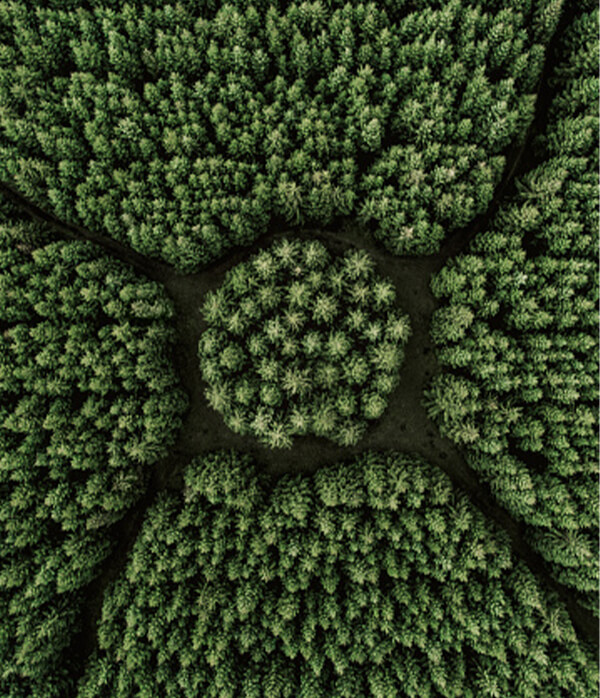

As consumers, many of the individuals and families we serve are considering the impacts of climate change, natural resource depletion, biodiversity loss, supply chain management and human rights across the businesses with which they interact. In their business and philanthropic activities, they are committing capital to innovations that address the world’s greatest challenges.

In common with the Private Bank and the wider Citi, many of our clients believe that private capital can and should be used to effect positive change.

Our clients are thus using their influence as investors to seek greater transparency into companies’ processes and impact, along with enhanced board oversight and ownership of risks.

They are also increasingly aware of other benefits of sustainable investing, such as holistic risk management, a diverse source of opportunities and potential returns. Investing with Purpose (IwP) is Citi Private Bank’s platform of sustainable investments.

We enable investors to pursue simultaneous societal change and competitive financial returns.

How we serve you

PORTFOLIOS BUILT AROUND YOU

IwP is the natural extension of our years of customizing portfolios for our clients.

We begin with an in-depth understanding of your sustainability goals and preferences and implement them with investments that meet your risk and return characteristics.

Our platform comprises opportunities across all asset classes. The Private Bank also offers self-directed sustainable investments in order to meet risk profile requirements and thematic preferences.

Thematic and impact investments can complement core portfolios through specific investments that finance innovation in sustainability sectors, such as affordable housing or renewable energy, complimenting managers that integrate environmental, social and governance (ESG) criteria into investment decisions. Impact investing, seeks to generate measurable impact in a particular environmental or social area.

INSTITUTIONAL-CALIBER ANALYTICS

To help guide the creation of your sustainable portfolio, a sustainability diagnostic can provide data-driven insights.

The Citi Wealth Investment Lab has developed proprietary tools to give you insights into the sustainability characteristics of individual securities and managed strategies. These include ESG risks, exposure to desirable or controversial themes and carbon footprint.

We can provide these insights in respect of all your holdings at Citi and elsewhere.*

OUR CULTURE OF SUSTAINABILITY

Citigroup is a long-time advocate of sustainability and inclusion practices in the financial sector and in society more broadly.

Meet our people

Harlin Singh Urofsky

Meet our wealth expert

Harlin works across Citi’s investment divisions to develop and embed a global framework along the full spectrum of sustainability to ensure its alignment with Citi’s best thinking on portfolio management, research and asset allocation. This includes environmental, social and governance (ESG) integration, socially responsible, thematic and impact investments.

Harlin is an observing member of the Global Investment Committee and oversees Investing with Purpose, our sustainable investing platform. She is also a representative on Citi’s Net Zero Task Force, entrusted with the group’s goal of reaching net zero emissions by 2050.

Prior to joining Citi in 2017, she served as Associate Director of innovative finance at the Milken Institute. Before that, Harlin spent over a decade as a capital markets and foreign exchange specialist, advising ultra-high net worth individuals and family offices at Deutsche Bank and Citi, having begun her career at Lehman Brothers. She also served as an adjunct professor of impact investing at USC’s Marshall School of Business.

Harlin holds an undergraduate degree in finance from Rutgers University and a master’s in public administration from New York University.

Your questions

The term “sustainable investing” is a collective descriptor for a range of approaches. Each of these has its own financial and sustainability objectives and can be applied across traditional and alternative asset classes.

At Citi Wealth, we identify four main approaches in this area: socially responsible investing (SRI), ESG integration, thematic investing and impact investing. These approaches are not mutually exclusive. A single investment strategy can combine some or all of them, targeting exposure according to an investor’s priorities.

There's a widespread perception that applying environmental, social and governance criteria means sacrificing performance. We disagree. Investment strategies on the Investing with Purpose platform are not concessionary. It is important to note that an investment strategy’s utilization of screens and other exclusionary tools to meet its sustainability objectives may affect its performance relative to its benchmark or the market as a whole because of these limitations. The performance of managers in this space may differ relative to the performance of other managers that employ similar strategies but do not expressly incorporate sustainability criteria into their investment strategy or the stock market generally. For example, strategies that integrate ESG criteria can be limited in the type and number of investment opportunities available, or the ESG criteria can cause a portfolio manager to avoid a well-performing security or sector.

A significant concern in the sustainable investing landscape is "greenwashing." This occurs when companies or funds exaggerate or misrepresent their environmental or social credentials to appear more sustainable than they actually are.

Navigating sustainable investments requires a comprehensive understanding of both traditional investment risks and those unique to the sustainable investing landscape. Greater regulatory oversight and enhanced transparency are vital. In addition, thorough due diligence is essential to ensure that an investment genuinely aligns with an investor’s sustainable investment objectives.