Taking advantage of the markets' big reset

While it may not seem like it just now, our analysis suggests that the global economy is healing and poised for further recovery, full of potential opportunities to build profitable and resilient portfolios.

This is a good time to be a global investor, maybe even a very good time.

If you find that hard to believe, you are not alone.

In 2023, we have seen moments when investors were absolutely sure that equities were headed lower (September) and when investors were absolutely sure that rates could only go higher1.In both cases, investor sentiment proved wrong. Nevertheless, as of the week ending November 15, investor confidence as measured by the American Association of Individual Investors stood at 16% net bullish, hardly a ringing endorsement for the future.2

With war in Ukraine and Israel, tensions ongoing between the US and China, impending contentious presidential elections in the US and six other countries, gridlock in the US Congress and abounding doomsday scenarios about the impact of artificial intelligence (AI), it is not easy to have a clear vision on the direction of markets. Meanwhile, 5% annualized short-term rates are distracting investors, encouraging them to quietly become market timers.

Steven Wieting

Meet our wealth expert

Steven heads our Global Strategy team which formulates our macro investment views across all regions and asset classes. He chairs our Global Investment Committee, which sets our tactical asset allocation, the basis for discretionary portfolios we manage for clients.

As Chief Economist, Steven provides detailed macroeconomic analyses to inform portfolio decisions.

Previously, Steven was Head of Economics for US institutional equities at Citi Investment Research. He advised the firm’s institutional and government clients globally on macroeconomic developments, forecasts and policy analysis.

He was also economic advisor to the Morgan Stanley Smith Barney Global Investment Committee and a voting member of predecessor Asset Allocation Committees at Salomon Smith Barney.

Steven has a master’s in quantitative economics from the Zicklin School of Business, Bernard M. Baruch College, City University of New York

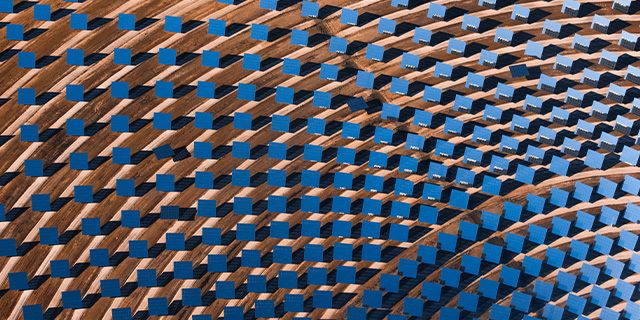

Core investment opportunities

Opportunistic investment trends

Unstoppable investment trends to watch

What now? Our investment insights have been helping families for generations. Request to speak to an investment specialist and put ideas into action.

Contact us

Contact us

Download your copy

Discover our Wealth Outlook 2024 insights and themes.