Investing in energy 2024

The world’s most powerful oil cartel has been become an accelerator of the green revolution. OPEC has decided to maximize short-term profits even if it means speeding its own decline. We see two clear sets of winners.

KEY TAKEAWAYS

Over the past several years, whenever oil prices have fallen, OPEC has repeatedly intervened by curbing production and restoring price stability, typically around $80 a barrel.

The strategy has been a gift to the green energy transition, creating a floor under the price at which alternative energy producers must compete with fossil-fuel-powered sources.

One set of winners has been Western producers and pipeline suppliers who get the benefit of the higher price without the production cuts.

Another set includes copper miners and spot copper, the one indispensable element in the global thrust toward electrification.

The transition from carbon-intensive to sustainable energy sources is accelerating. The cost of new electricity generation from the major alternative energy sources like wind and photovoltaic solar has fallen below that of building an equivalent new fossil-fuel-fired plant (Figure 1). Major, ongoing advances in green technology and economies of scale are driving this historic shift.

But there is another, unlikely driver that has come into sharper focus: the vitally supportive role of OPEC, the Organization of Petroleum Exporting Countries.

FIGURE 1: Global cost of adding new green electricity capacity relative to building an equivalent new fossil-fuel-fired plant

Source: Bloomberg as of December 31, 2022

The world’s most powerful oil cartel has become an accelerator of the green revolution. Climate change and the rapidly falling cost of energy alternatives likely signal OPEC's ultimate demise. Thus, OPEC is faced with two choices: delay the inevitable by expanding production, lowering fossil fuel prices to compete with the price where alternatives compete, or alternatively maximize their current income by maintaining higher prices for as long as possible, even by reducing output to do so.

Evidence thus far suggests that OPEC is opting to increase its cash flow while making the likelihood of a faster rate of decline for oil output more likely. On repeated occasions over the past several years, whenever oil prices have fallen from lack of demand or higher supply in other parts of the world, OPEC has consistently intervened, curbing production and restoring price stability, typically around $80 a barrel (Figure 2). This strategy has been an unmitigated boon for the green transition, which has entered a critical stage of more aggressive developed-market government support aimed at accelerating private-sector take-up: a take-up that’s considerably more likely with oil at $80 than $40.

Figure 2: Since the pandemic, OPEC production cuts have kept oil prices from falling too low.

Source: Haver Analytics as of October 31,2023. Past performance is no guarantee of future results. Real results may vary.

OPEC’s gambit has produced other unexpected winners. While OPEC’s strategy is designed to maximize its short-term profits, it is doing so by “taking the hit” for all oil and gas producers as it lowers its own production. That is not the case for Western producers, pipeline suppliers and other services. These companies get the benefit of the higher oil price without the accompanying production cuts and, in yet another irony, may be among the biggest winners of this next, strange phase of the energy transition.

The right cartel for the job

In 2015, world leaders congregated in Paris for the 21st Conference of the Parties (COP21). Their unanimous resolve led to the Paris Agreement – a global pledge to combat the looming threat of climate change. Their core objective? Swift transition from carbon-laden fuels to greener, sustainable alternatives that would keep a global temperature rise under 2° Celsius above pre-industrial levels.

Such a shift isn’t solely reliant on technological innovation or political will. It is also a function of the resources available for communities to wean themselves from their dependency without destroying growth or exacting widespread scarcity and pain. In recent COP conferences, there has been particular emphasis on the balance between these competing priorities in developing countries, which are now responsible for some two-thirds of all global emissions,1 but also would be among the biggest casualties from a sudden withdrawal or skyrocketing in the price of traditional energy sources without ready and affordable replacements.

From early in the COP deliberations, it became apparent that the free market would need to play an important role in allocating these resources. Equally apparent was that the free market is not at its most efficient in pricing in externalities such as the impacts of climate change. Many of the actions taken by individual governments since, like the EU carbon tax or the US tax breaks and power plant rules, are designed to force those externalities into the free-market pricing and imbue it with a greater sense of urgency than it could muster on its own. But there is also another way to artificially set prices to incentivize the desired behaviors: let a cartel do it.

OPEC’s long shadow in the green transition

Imagine if OPEC took a more aggressive stance “against” the green transition. We would have seen a collapse of the market price for oil and gas. While this would have produced undeniable economic benefit for households and businesses around the world, it would have come at a cost. OPEC could have set back the transition to a sustainable energy economy by years, possibly decades.

Instead, we have a situation where OPEC has kept the oil price at an almost ideal level to drive alternative energy development forward. Oil prices are low enough where many people can still afford to fill up their car and power their home until more green capacity becomes available, but high enough to see further investments in the critical infrastructure needed to keep the transition at least more-or-less moving forward. That’s why it is no coincidence that the most recent COP conference this November is taking place in Dubai, where OPEC participated for the first time.

The question is, what is OPEC’s end game? We think the answer comes down to a cold, hard self-assessment of its own future. Saudi Arabia, the largest of the OPEC countries, for example, has staked out an ambitious agenda reimagining the entire country as a global commercial hub with a diverse economy built around finance, tourism, technology, services, and abundant solar power, not oil. Almost every aspect of its long-term planning is geared toward this one set of goals, but those plans also take money. And as vast as the kingdom’s resources are, it seems to recognize that even more is needed, and at a faster pace apparently than even has been earned in many periods before. That’s why OPEC is “taking the cash now” option by keeping prices higher for longer.

Unexpected investment implications

We see a range of major beneficiaries of OPEC’s decisions. Near the top of the list are Western energy producers. These companies, which are not acting as the supply shock absorbers for marginal oil demand, are clearly benefitting as they produce at full volume.

Green energy producers with strong balance sheets can also see opportunity – eventually. Despite the surge of large-scale investments into green energy over the past few years, substantial profitability among green energy producers remains elusive. Much of the reason has to do with a very different supply-demand dynamic associated with producing green energy. With a primary input that is essentially free, all the economics are geared toward producing and selling the output at the cheapest cost possible. This requires large amounts of capital for infrastructure. And with today’s high interest rates, that has become more expensive and harder to come by.

Some companies, through sheer dint of their size and regulated rate bases, can eventually get back to generating consistently respectable returns. They’ll do this by becoming a cleaner version of an electric utility. Still, that’s not an individual idea of a vehicle for short or even medium-term growth.

Substitutes for the green technologies

Higher up on the green energy value chain are the producers of the technology used in green energy production. In recent years, some of these companies have produced impressive earnings and share price growth. This is largely a high-scale, low-margin business. A handful of producers in China dominate the markets for solar panels and electric batteries, so that few other companies in the world can compete.

Investment in these leading producers is caught up in the geopolitics between China and the US. So, while there will be higher-beta opportunities in specific technologies like green hydrogen or new battery chemistries, it’s not yet clear who the winners will be.

Copper connects us to a green future

For these reasons, in addition to Western energy producers, we favor irreplaceable inputs. We especially like copper, a commodity that, like oil and gas, benefits from natural supply constraints, but with much more durable, now-booming demand. For the foreseeable future every aspect of the global thrust toward electrification will require increases in global copper production and recycling.

In contrast, lithium, the highest-value input in today’s leading battery chemistries, also benefits from near-term demand pressures but could increasingly face substitution risk as rival technologies emerge. Sodium could eventually crush lithium on price and availability. The only other metal able to compete with copper’s conductive powers, meanwhile, is silver, which is considerably more expensive and rarer. Beyond that, the next threat on the horizon would be the first generation of commercially available room-temperature superconductor materials, decades from now, at the earliest.

By then, OPEC should be nearing the final phases of its exit from the center stage of global supply and demand, by which time all of us – investors and humans alike – could owe it an enormous debt.

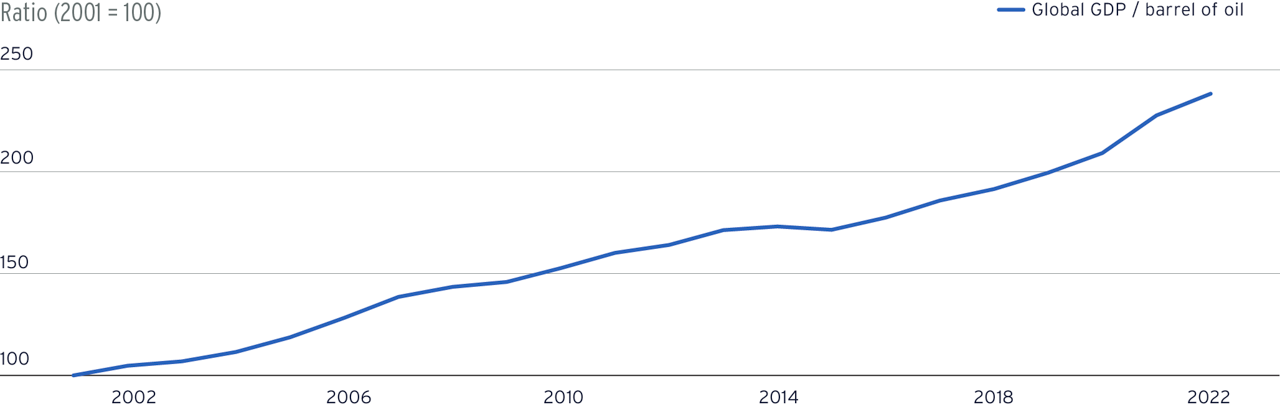

Figure 3 & 4: From at least a pure gross domestic product (GDP) standpoint, the global economy is increasingly weaning itself from oil.

Source: Haver Analytics as of November 15, 2023.

Source: Haver Analytics as of October 31, 2023.

Download your copy

Discover our Wealth Outlook 2024 insights and themes.