Fixed income opportunities 2024

The benefits of intermediate bonds have grown, especially at (somewhat) longer durations.

Key takeaways

Barring a surprise inflation scare, the US Federal Reserve (Fed) hiking cycle appears to be at its end.

Present yields for all bonds are historically high and build in significant “real yield” premium over expected inflation.

If unemployment rises in 2024, the Fed is likely to cut rates. This prospect of appreciation adds to the appeal of adding intermediate-term US dollar (USD)-denominated bonds to portfolios.

Potential opportunities include intermediate-maturity US Treasurys, investment grade credit and municipal bonds. While US Treasurys do not have credit risk, it is possible for investors in Treasurys to experience losses if interest rates rise above their initial purchase level and the investor subsequently chooses to sell prior to maturity. Investment grade rated corporate and municipal bonds have this interest rate risk, as well as the credit risk of the issuer.

Suitable investors may consider fixed income exposure in higher credit quality bonds averaging an intermediate maturity. Various maturities have different purposes in diversified portfolios.

Use higher yields to seek portfolio income

This past year, most US Treasury and credit indices suffered losses as the Fed continued to raise its policy rate. Credit indices, in contrast, performed substantially better as the economy was stronger than expected, and credit spreads tightened during the year. These credit spreads, when added to higher underlying Treasury rates, combined for a powerful “income effect” from corporate bonds due to higher starting current yields. Credit benefits from spread tightening also offset some of the mark-to-market losses from Treasury rates moving higher.

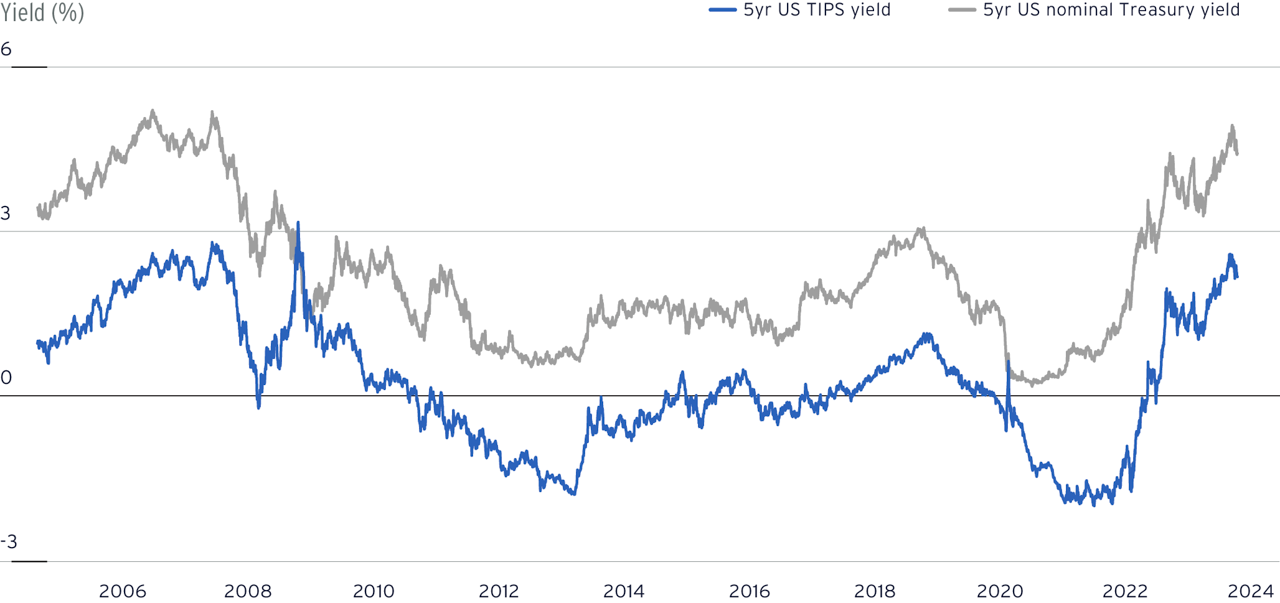

We believe the currently high level of Treasury yields, particularly when combined with high-quality credit, can add substantial and durable income to suitable diversified portfolios. Current yields are well above expected headline inflation (as measured by Treasury Income-Protected Securities, or TIPS). This means that investors can lock in “real” income. We estimate this post-inflation income to be roughly 225 basis points for 5-year Treasurys alone above the current (2.23%) rate of expected headline inflation as of November 24, 2023. This is one reason we believe that core portfolios are a strong investment.

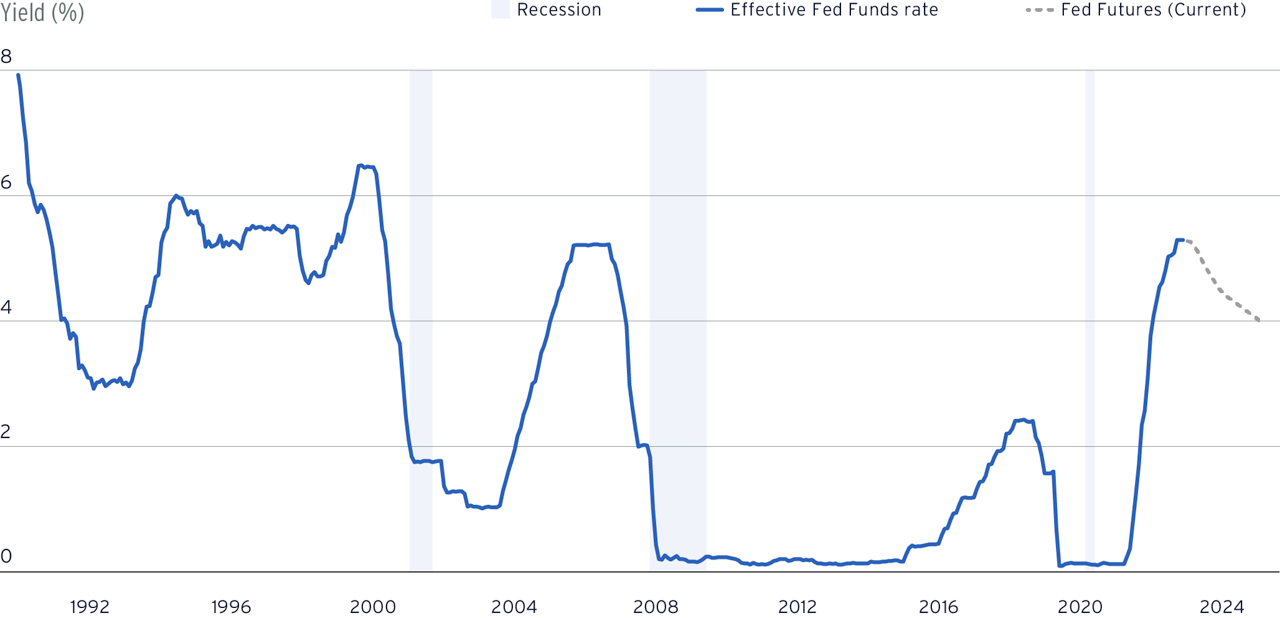

The impact of higher rates is not over. Ultimately, chances are that the Fed’s actions will gradually slow global economic growth, while also raising US unemployment. As unemployment rises, we believe the Fed will move pre-emptively to begin lowering its policy rate, in turn perhaps resulting in sharply lower yields across the curve (Figure 1).

As such, 2024 may be a beneficial year for bondholders who add intermediate-maturity bonds to portfolios to lock in potentially peak interest rates. If rates drop, there is capital appreciation to be captured, while the current income protects investors to the extent that rates stay higher for longer. “Intermediate-term” in this case means any issues with five-to-seven years to maturity or less, although this will depend on one’s overall investment objectives and suitability.

We present several high-quality fixed income asset classes to consider.

Figure 1: Fed Funds Rate implied by Fed Funds futures.

Source: Bloomberg, as of November 22, 2023. All forecasts are expressions of opinion, are subject to change without notice, and are not intended to be a guarantee of future events. Past performance is no guarantee of future results. Real results may vary.

US Treasurys

US Treasurys come in many different maturities, but currently, all maturities offer high nominal and real rates by recent past standards. As we said, these high US government rates are also near historically high levels compared to expected headline inflation as measured by TIPS (FIGURE 2).

Figure 2: 5-year Treasury rates high compared to expected headline inflation

Source: Bloomberg as of November 22, 2023. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary.

Investment grade credit

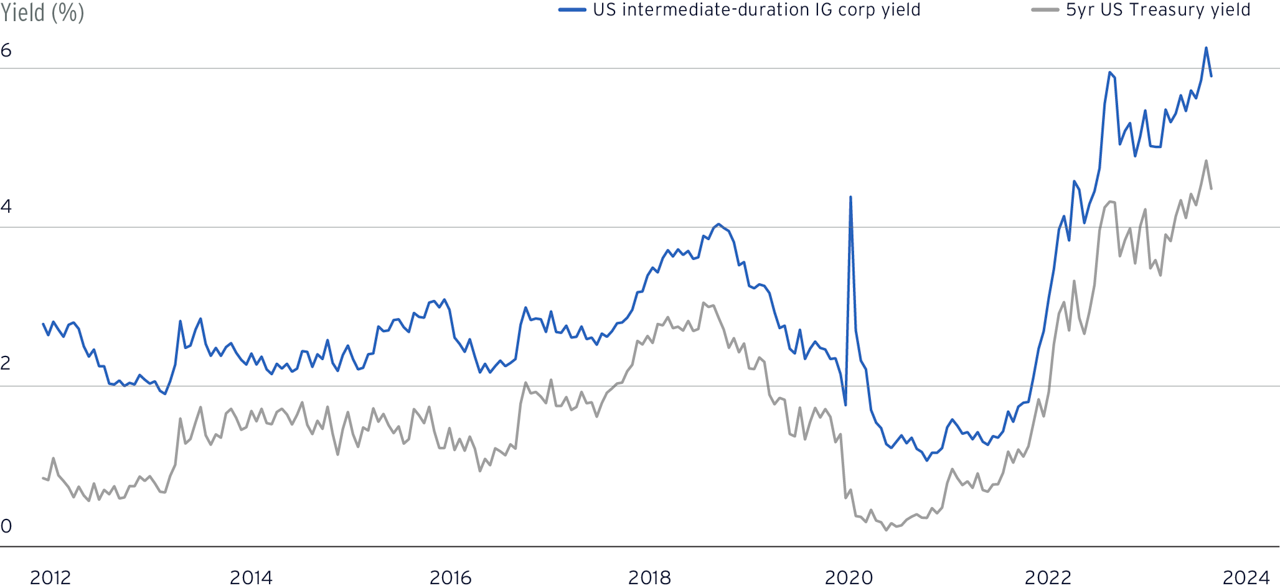

Corporate bonds have higher yields than Treasurys of comparable maturity, reflecting corporates’ relatively higher credit risk. Still, the repayment risk for intermediate-term investment grade (IG) bonds issued by large, healthy companies with low levels of debt compared to earnings is generally much lower than it is for lower-rated high-yield bonds with higher level of debt to earnings. The intermediate-term IG index comprises debt of 1- to 10-year maturities, with low overall average duration – or price sensitivity to interest rate changes – of about four years. The IG index currently yields about 5.71%, about 1.05% above comparable-maturity (i.e., 4-year) Treasury bonds (as of November 23, 2023, Figure 3).

Besides investing in an ETF or mutual fund whose strategies are an index, investors may consider individual bonds, as there may be higher yield levels on individual IG-rated bonds for suitable investors who understand the credit risk of the issuer. An index is an “average” of yields, so often there are numerous examples of high-quality credits that pay above-index yields. For example, recently many of the largest US banks’ bonds of around 5-year maturities yielded more than the IG index referenced above. For those wishing to seek returns above those of the index, actively managed fixed income strategies can be considered.

Figure 3: Intermediate-term corporate yields vs 5-year US Treasury yield

Source: Bloomberg, as of November 22, 2023. Bloomberg Intermediate Corporate Total Return Index used for US intermediate-duration IG corp yield. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary.

US municipal bonds

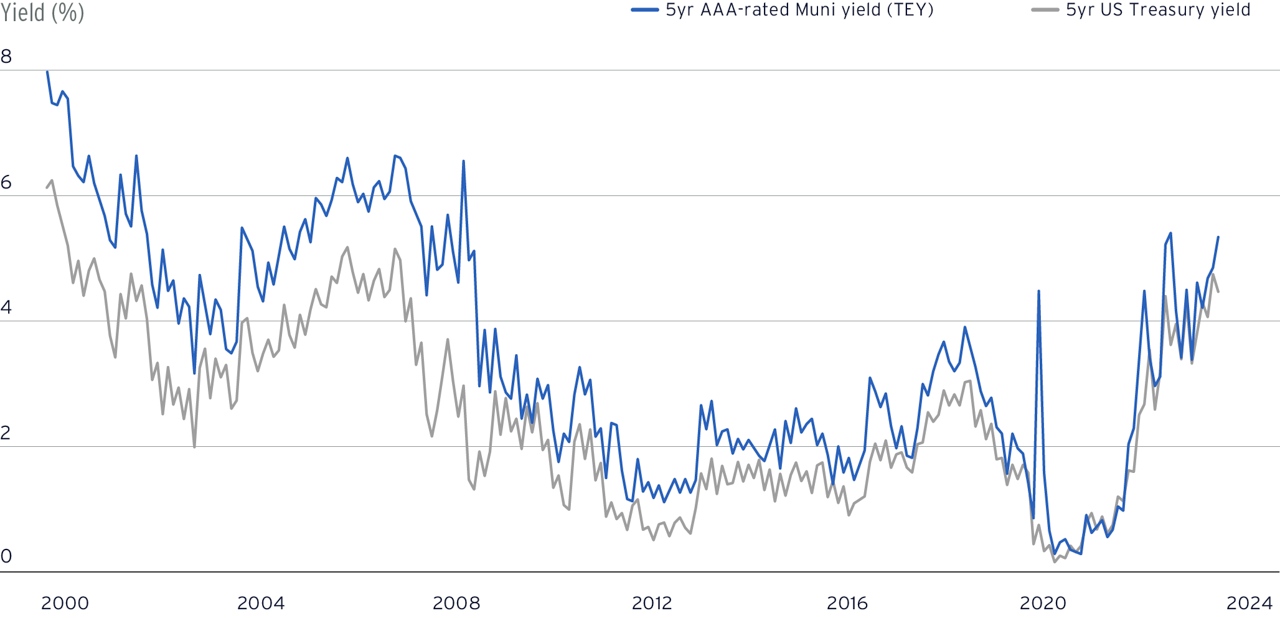

For investors eligible for the tax advantages, highly rated US municipals (“munis”) may be an interesting short-term fixed income opportunity. Munis generally pay a “tax-equivalent yield” near the equivalent Treasury yield ( Figure 4 ). However, sometimes that tax-adjusted yield can be higher than Treasurys as it was earlier this year. When that occurs, the tax-equivalent yield, especially for US taxpayers in high-tax states, can offer similar yields to investment grade, except with government (i.e., very low) credit risk.

Figure 4: Muni yields may be attractive for tax-advantaged investors

Source: Bloomberg as of November 22, 2023. Note: Tax equivalent yields (TEY) adjust for top Federal and Affordable Care Act tax rate (40.8%). SIFMA Municipal Swap Index Yield used for yr AAA-rated Muni yield. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary.

Download your copy

Discover our Wealth Outlook 2024 insights and themes.