Citi Private Bank

Serving worldly, wealthy individuals and families.

GLOBAL PRIVATE BANKING

Customized private banking that crosses borders. Sophisticated financial services to preserve and grow wealth worldwide.

Serving the world for over 200 years

Providing global banking services that enable clients to flourish and grow on their journey from ambition to achievement since 1812.

1812

City Bank of New York is founded

1820

Our journey in trust and estate planning begins

1865

City Bank becomes National City Bank of New York

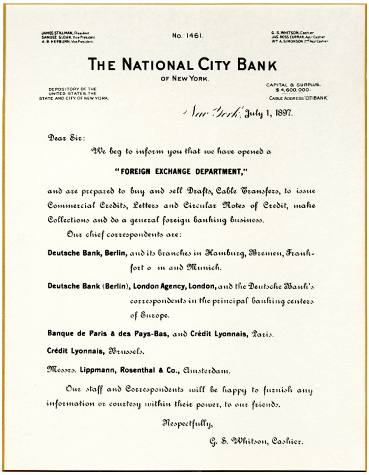

1897

Our organization enters the foreign exchange business

1915

National City Bank gains a foothold in Europe

1935

Citi Investment Management starts managing portfolios

1960

Citi Trust's first overseas trust company is born

1971

Our Law Firm Group is founded

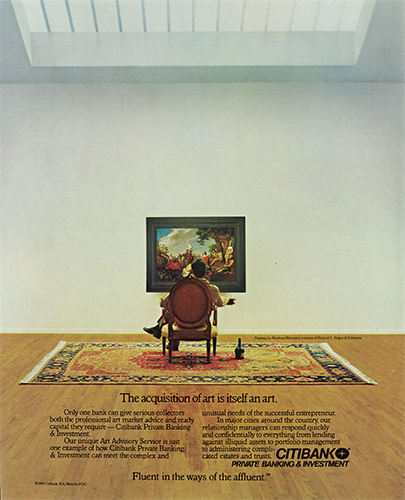

1979

Citi’s Art Advisory & Finance business is born

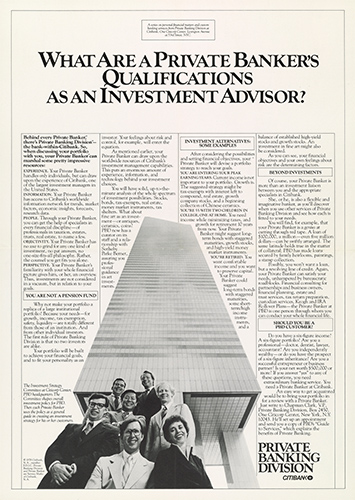

1986

The Private Banking Group is established

1998

Citicorp announces $140bn merger with Travelers Group

2009

The Private Bank appoints its first female CEO

2021

The Private Bank joins forces with Citi Global Wealth

Today

We serve clients from 60 offices globally

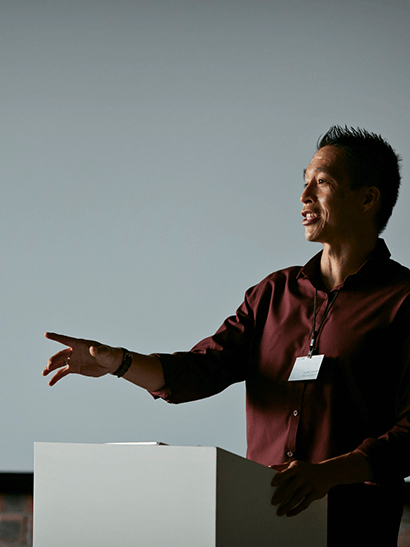

One global team

Working closely with Citi’s Institutional Clients Group, Citi Private Bank offers access to the world’s most sophisticated services for wealth.

Our unique community

The events and introductions we provide create vital connections between clients of the Private Bank.

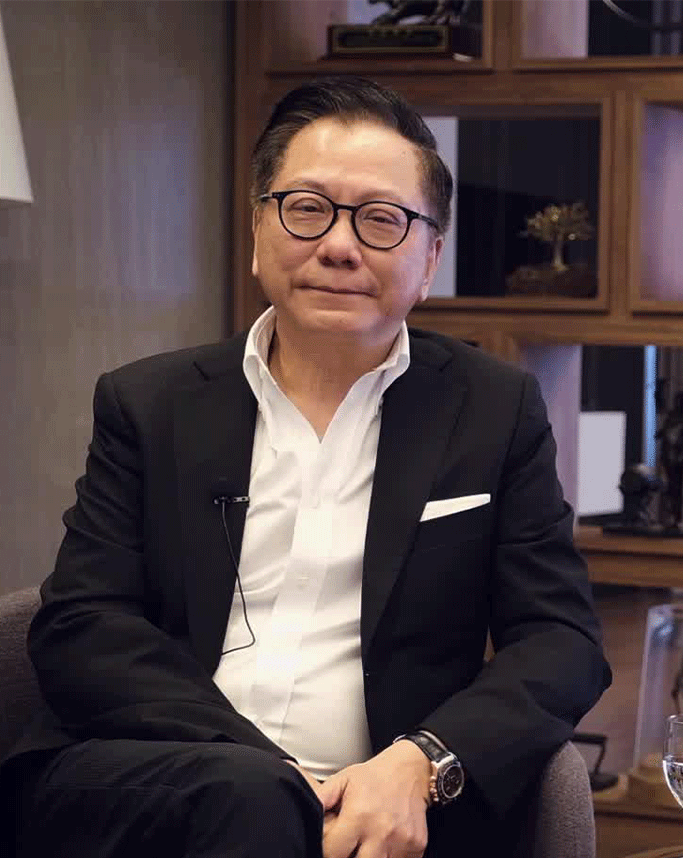

Global citizens

We serve inspirational individuals and families who make an outstanding contribution to the world around us.